Introduction

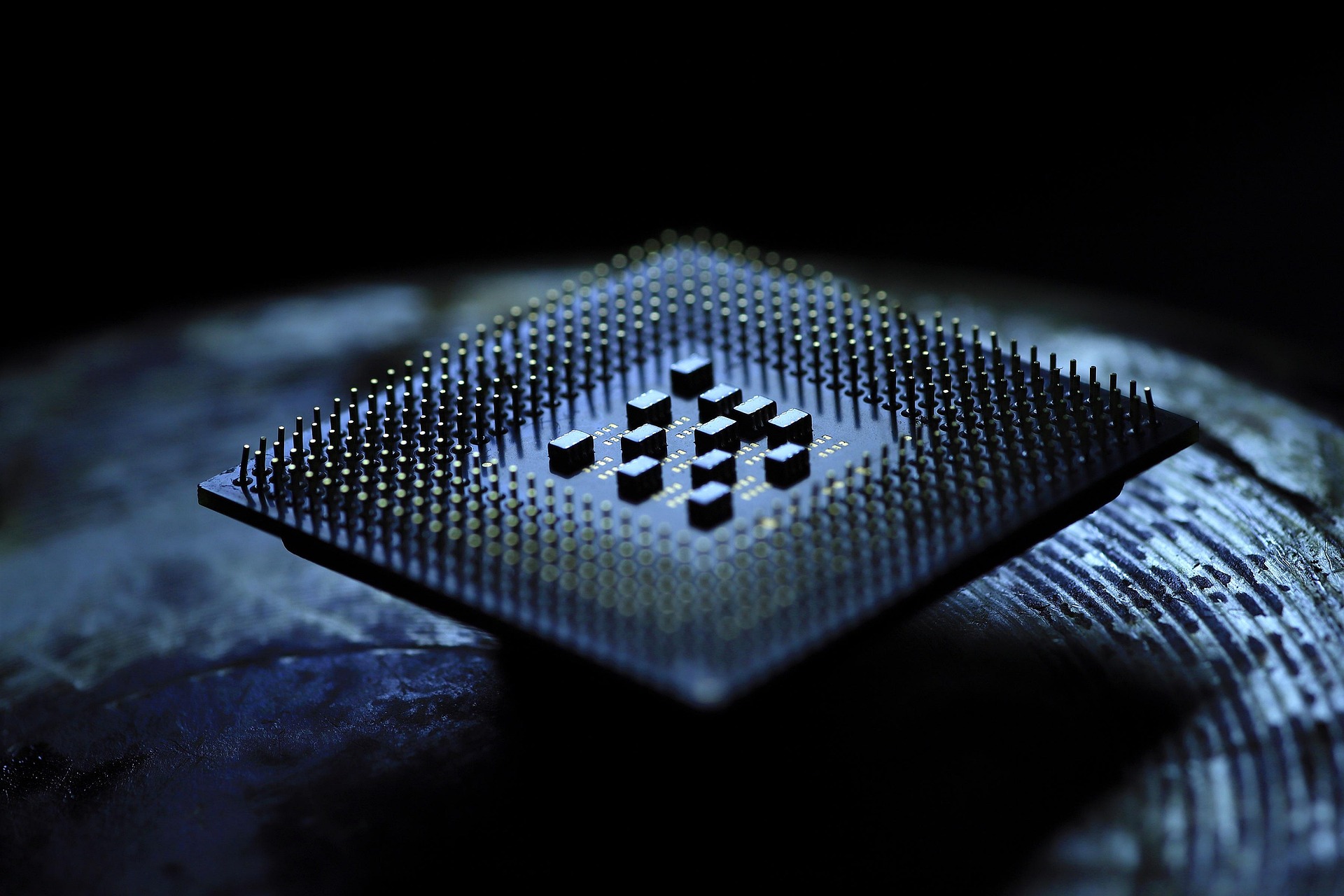

The hum of the server has replaced the clang of factories. In 2025, the pulse of the world’s economy beats not in oil rigs or assembly lines but in data centers, powered by the small, intricate silicon hearts of artificial intelligence. This week, that heartbeat grew louder.

After months of speculation, the world’s leading AI chipmakers from California to Taipei reported record breaking profits, sending tech stocks surging and reigniting the kind of market euphoria not seen since the early days of the internet boom. The numbers were staggering, but the mood behind them was something deeper: a sense that we are living through a technological reordering of value itself.

Investors aren’t just chasing the next gadget anymore. They’re chasing the infrastructure of intelligence the chips, networks, and systems that will define the next era of computation.

The spark behind the rally

It started with earnings results from one of the industry’s biggest players that beat expectations by an astonishing margin. Revenue soared on surging demand for the AI processors, or specialized chips that train and run large language models and generative AI platforms. Orders from cloud giants, governments, and research labs have topped even the most optimistic forecasts.

Almost overnight, the sector’s performance reignited broader investor enthusiasm: The Nasdaq reached new highs, semiconductor indexes jumped double digits, and smaller technology firms linked to AI infrastructure from cooling systems to optical connectors rallied in tandem.

What sets this boom apart from previous bubbles is its bedrock. Unlike the speculative exuberance of the early 2000s, today’s growth has attached real demand to it. AI is no longer a promise; it’s a business model, and chips powering it are its raw currency.

When chips become the new oil

For decades, semiconductors were seen as the quiet backbone of the digital world. Now they are the headline. AI has transformed them into what some analysts describe as “the new oil” a strategic resource that powers productivity, innovation and geopolitical rivalry.

But from chatbots to self driving cars, all of them require immense computing power: training them requires the use of thousands of GPUs running for weeks or even months. That makes companies that can manufacture or even design these chips the gatekeepers of the new economy.

That scarcity both of chips and of the expertise to design them explains why profits have exploded. Demand is exceeding capacity, even as factories expand across Asia and the US. Well meaning supply chain diversification efforts take years. For now, the bottleneck remains and prices keep climbing.

The investor frenzy

Of course, markets respond not just to fundamentals but to emotion, and the current surge in tech shares has revived that old thrill of possibility that elusive belief that technology can still change everything. AI has given the sector a new story to believe in, one that merges science fiction with quarterly earnings.

From New York to London, portfolio managers on trading floors talk about AI as an opportunity and an obligation. Funds that missed the first wave of the AI boom are now scrambling to catch up, pouring billions into semiconductor stocks. Analysts warn overheating has set valuations comparable to the dot com bubble. However, some others argue this time the difference is in scale: the technology is already transforming industries, from healthcare to logistics.

Whether that translates into reality is, of course, a different matter altogether.

Beyond the numbers: a shift in power

The AI chip profits surge is not only a story about economics; it’s a geopolitical story. Nations are racing to gain access to advanced semiconductors in the belief that whoever controls computing power controls innovation and now, increasingly, influence.

The United States is doubling down on domestic manufacturing subsidies, while China, constrained by export bans, accelerates efforts to develop homegrown alternatives. At the center of this global tug of war are Taiwan’s semiconductor giants, balancing business ambition with strategic vulnerability.

Each earnings report is thus more than a financial update; it is a measure of how technological sovereignty is being redrawn in real time.

The paradox of abundance and constraint

What’s striking about the current boom is its contradiction: limitless demand meeting limited capacity. While AI promises efficiency and abundance, the physical world of chip fabrication remains bound by scarcity. Factories can’t appear overnight; raw materials are finite; talent is concentrated.

This tension between digital expansion and material constraint is what keeps the sector volatile. It’s also what gives it power. Investors understand that whoever can break through those limits whether by scaling production or innovating new architectures will define the next decade.

In a way, this rally has been about belief in human ingenuity just as much as about profit.

The ripple effect across markets

Other sectors are now being pulled into the orbit of the tech surge. Cloud service providers are expanding infrastructure spending. Electric grid operators warn of surging energy demand from data centers. Even real estate developers are racing to build industrial parks for semiconductor production.

For financial markets, AI is no longer a niche theme; it’s the new macro narrative. Bonds, currencies, and commodities are reacting to it. Countries supplying key chipmaking materials, such as South Korea and Japan, are seeing their currencies strengthen. Meanwhile, traditional safe havens such as gold and treasuries are losing some of their allure as investors rotate back into risk assets.

The excitement has trickled down from institutional investors: retail traders, long dormant after the 2021 tech slump, have emerged with a vengeance. They flood into semiconductor ETFs and AI related startups, with social media humming once more with charts and hashtags about “the future of intelligence.”

The caution beneath the euphoria

And yet, beneath the excitement, the old lessons linger. Markets that rise too fast tend to forget gravity. The same algorithms that fueled profits today could amplify losses tomorrow if expectations falter.

Analysts warn that margins could compress as competition increases and capital expenditures soar. Governments are also watching closely: the geopolitical importance of semiconductors makes regulation inevitable. Environmental concerns, too, are mounting, as the energy footprint of AI infrastructure grows exponentially.

Yet momentum still belongs to optimism. So long as corporate earnings continue to beat forecasts, few investors are hanging back.

The meaning behind the numbers

This isn’t just a surge about money. It’s a collective sense that we’re witnessing something akin to a technological inflection point, like the beginning of either electricity or the internet. Every record profit, every surge in valuation, reinforces a feeling: that intelligence itself, once a human monopoly, has become an industry.

There is awe and unease in that realization: The same chips driving the stock market are shaping futures of work, creativity, and power. The wealth they generate is real, but so are the questions they raise over concentration, inequality, and control.

Conclusion

Record profits posted by makers of AI chips have done more than lift markets they’ve reignited imagination. For investors, the rally is proof that innovation still pays. For societies, it’s a reminder that the next great economic era is being built not with steel or oil, but with code and silicon.

But every boom has its shadow. The line between revolution and speculation is very thin, and it is a line the world has crossed before. Yet, in all the noise and numbers, there’s one truth that does stand out: the age of artificial intelligence isn’t coming anymore; it has arrived, and it’s profitable.